Happy 2025. When I started Failing Forward last year, I spoke about two core motivations for the project.

The first is to pay forward my failure to others. Having started and shut down a company, I am sharing learnings to help other founders avoid our fate. Most of my posts have done this by covering specific topics, such as the need to build a must have product or die.

But something unanticipated has happened on the way: the process of writing these posts, of putting down lessons and explaining them to others, has actually changed and clarified my own learnings. Through the process I am developing a much better understanding of what happened, what I might do differently, and how I feel today in retrospect. It is therapeutic, cathartic and instructive. Thus I am more truly living my second intention, to move forward from failure, than expected.

And in moving forward, I have had this nagging urge. This itch that I cannot let go, and need to scratch. So I am actioning it today by putting out our full story in the most raw, unvarnished and unfiltered way that I can. I want to expose the Workstream journey in all its glory and horror so that others can draw their own conclusions without my post hoc voice inserted.

So today I am publishing in multiple formats our contemporaneous investor updates sent when building the company. This post is intended as a place for the reader to explore, determine for themselves what we did right, where we were wrong, and when the gods of luck blessed or damned us.

To get started, read on to the below section, Don’t Panic: How to Navigate this Bear. And from there choose your own adventure.

With love, Nick.

Don’t Panic: How to Navigate this Bear

This post includes three core parts:

#1 - The full text of my quarterly investor updates, sent from January 2020 to May 2024.

Substack estimates it will take you 84 minutes to get through all 20,000 words. So read in full if you are so inclined, but instead I recommend you start with #2 (a podcast) or #3 (a written timeline) to get a high level sense of the journey. From there, circle back to read specific investor updates in depth via the table of contents included below.

In the table of contents, you can navigate to each investor update, included in full along with descriptive titles (written more recently) such as: False Signals & Hitting $100K in ARR (August 2023). Further, I have broken the entire text into four distinct chapters into which all the investor updates are now grouped.

The first chapter, Founding and Alpha for Analytics Collaboration, covers our pre-seed funding, and our march towards our alpha release amidst the pandemic in 2020. The second chapter, The First Pivot, charts our evolution into focusing on data team workflows, starting in late 2020; it ends with the closing of our Seed about 15 months later.

The third chapter covers our push to Monetize our Data Knowledge Management product against the backdrop of the tech downturn and personal challenges for me at home; it concludes with us hitting $100K in ARR and feeling false hope. The final chapter, the Ride of the Rohirrim, chronicles the end: the immovable wall we ran into with sales, and our attempt to save it all with one final pivot that seemingly worked before we ran out of time and capital.

#2 - A 15 minute AI generated podcast created by Notebook LM

I asked Google’s Notebook LM to create a podcast based on the raw updates and our financing materials. Press play at the top of this post to give it a quick listen.

I find this a fun and engaging way to consume the content. I am myself largely impressed by the tech, as the “hosts” generally gets things right — other than some examples, such as why our final pivot did not work. (For that, I would rely on my final two investor updates: Leaving it All on the Field and Shutdown).

#3 - An AI Generated Timeline of Events

Notebook LM also created a timeline of critical events which I am sharing immediately below. If you aren’t a podcast person, just read this overview to start. Like the show, it will help you determine which posts you might want to read in more detail.

Please note that with the intent of keeping this pure of my retrospective voice, I did not edit the AI’s content. So for any inconsistencies please trust what I wrote in my updates. But with that caveat, I hope that you find this all helpful!

Don’t hesitate to reach out to me with questions, or if you want access to the Notebook LM to directly query it (Google won’t let me make it public).

AI Generated Timeline of Events

Late 2019

Nick Freund pitches Workstream to investors, seeking $1.5M in pre-seed funding. The pitch deck outlines a freemium pricing model with Individual, Team, and Enterprise tiers, and a go-to-market strategy focused on collaboration, discovery-driven upgrades, and strategic partnerships. Key milestones include initial development in Q4 2019, beta launch in 1H 2020, and general availability and company launch in 2H 2020.

2020

January: Workstream secures over $1.6M in pre-seed funding, exceeding the initial target. Nick Freund announces the funding and outlines plans for regular investor updates. The company focuses on refining the product experience and developing a clickable prototype.

March: Workstream expands its team to six, including a Product Designer, Front End Architect, Senior Software Engineer, and a contract engineer. The company conducts prototype reviews with potential customers, receiving positive feedback and validation for the product's potential. Development continues towards a private beta launch planned for mid-year.

May: The COVID-19 pandemic impacts Workstream's customer engagement efforts. However, the company recognizes the increased relevance of its solution in the new remote work environment. Workstream announces the upcoming launch of its beta program, generating significant interest and positive feedback from potential customers.

July: Workstream begins alpha testing with internal team members and close design customers. Initial feedback is positive. The company focuses on validating the minimal viability of its initial release and identifying necessary features and tweaks. Plans for a private beta phase are solidified, with a focus on establishing initial use cases and a feature roadmap.

October: Workstream launches its private beta with a select group of design customers, including best-in-breed analyst teams at companies with 300+ employees. Feedback is overwhelmingly positive, with users praising the product's design, functionality, and potential. The company gathers valuable insights into customer needs and use cases, informing future product development.

2021

April: Workstream refines its product vision, focusing on empowering analytics teams to support their assets as internal products and engage stakeholders as internal customers. The company introduces the concept of a "Knowledge Repository" to help data teams manage and communicate the context of their analytical assets.

July: Workstream releases v1 of its remixed product vision, including a web application (Knowledge Repository) and a browser extension (Workstream Concierge). Beta customer base doubles. The company prioritizes accelerating time to value for data teams, delivering features for core use cases, expanding the private beta, and preparing for public launch.

October: Workstream files a provisional patent application for its technology that registers assets, dynamically embeds them, and renders content within data visualization tools. The company focuses on integrations with data stack providers to enhance value and automate communication about data quality. Plans for a Seed round are underway.

2022

April: Workstream raises a $4M+ Seed round led by prominent VCs and angel investors. The company experiences increased adoption of its private beta and prepares for a public launch. Workstream releases new features and integrations, including dbt Cloud, JIRA Cloud, support for Thoughtspot and Salesforce assets.

August: Workstream launches its public beta and announces its Seed financing. The company hires business talent, including roles in sales, marketing, and customer enablement. Workstream focuses on establishing a go-to-market strategy, generating awareness, and growing its customer base.

January 2023: Workstream secures its first paying clients, crossing the "pennies barrier" and becoming a revenue-generating company. The company focuses on converting additional accounts, building sales pipeline, and accelerating its sales cycle.

2023

February: Workstream wraps FY 2022 with $50K in ARR.

May: Workstream raises total ARR to $81K, landing its largest customer to date (Feeld). The company redefines its ideal customer profile, honing its messaging around data knowledge, and highlighting its benefits.

August: Workstream surpasses $100K ARR and sees promising results from its data knowledge category creation efforts. The company's social media impressions grow significantly due to its investment in video content and data knowledge initiatives.

November: Workstream experiences flat sales growth due to the challenging macroeconomic environment and lack of urgency among prospects for adopting data knowledge solutions. The company pivots its go-to-market strategy by introducing a new data incident management module and lowering its pricing.

February 2024: Workstream concludes FY 2024 with $69K ARR. The company experiences churn and recognizes the need for a new direction. Workstream launches a free Core SKU for data incident management with the goal of attracting new customers through a product-led motion.

2024

May: Workstream shuts down operations, unable to secure additional funding or a suitable acquisition offer. The company cites challenges in the macroeconomic environment, the perceived "nice-to-have" nature of its data knowledge solution, and the lack of conviction around its new data incident management offer despite promising early traction.

FULL INVESTOR UPDATES

Chapter 1: Founding and Alpha for Analytics Collaboration

Chapter 3: Monetizing Data Knowledge Management

Chapter 4: The Ride of the Rohirrim: PagerDuty for Data

Founding and Alpha for Analytics Collaboration

Pre-Seed Wrap (Jan 2020)

To Our Workstream Investors,

Happy New Year -- we are excited to announce the details of our initial financing round!

We are excited by the amazing support we have received for what we are building, with our total capital committed north of $1.6M, against our initial target of $1.5M. In the past week, you should have received an email from Carta with your SAFE certificate that you need to accept -- if you for some reason have not seen it please let me know.

We have a great group of investors in the round, from experienced operators and entrepreneurs, to venture capitalists doing private investments to angel investors. Please bear with me while I get a cap table with the details published, as I am wrapping up a few final investors in the next couple of days.

Going forward, I am planning to send out investor updates on a regular basis -- but in the meantime, I wanted to communicate a few highlights on where the business currently stands, and what we are focused on today.

Team

In early November, Chris Ibarra joined as our Co-Founder and CTO. Chris and I were introduced through a close mutual friend and former colleague (the VP of Engineering at BetterCloud, who I worked with closely during my 6 years there, and who Chris worked with previously). Chris and I spent a lot of time getting to know each other and working together on nights and weekends before Chris made the formal decision to join Workstream.

Two weeks ago we had a very talented Front-End Architect join the team part time. In addition, since last November, we have also had an excellent User Experience (UX) Designer who has been helping out part time to define and design our initial product experience. We are getting amazing throughput from these resources.

We are of course working to turn these into full-time roles, and we are actively hiring for a number of other roles to fill out our early team (see the bottom of this email for links to job descriptions -- any referrals are most welcome).

Product

We are heads down in the early stages of development. We are focused on both research and development of early integrations (i.e, Microsoft Excel and Google Sheets), as well as systems design. We will begin laying down production code within the next month.

In parallel, we have spent hours refining our initial product experience, and now have a working, clickable prototype of what we believe our product will look like at private beta. I am actively re-engaging with potential customers to get feedback on the prototype, and validate key product assumptions. (The conversations have been very positive and productive so far). From there, we will look towards locking product scope ahead of our major development push towards our private beta launch later this year.

Please don’t hesitate to reach out if you have any questions on the above or the business in general. Again, I would like to express my sincere thanks for your support, and I could not be more excited to have you along for our journey in the upcoming months and years.

Best,

Nick Freund

Founder and CEO

Open Roles

First recruits, MVP validation & development (March 2020)

Hi Everyone,

I hope that this email finds you well, it has been around six weeks since my last update. I am happy to report that we have made material progress across the business, from building our team, to customer engagement & product validation, to software development.

Our Team

Our initial team is fully staffed for our push towards private beta in the middle of this year. In total, the team includes six people, with five full time team members and one contract engineer giving us additional bandwidth.

From a roles perspective, in addition to startup CEO duties I am leading product. I am working closely with our very talented new Product Designer who has come onboard full-time.

In addition to serving as CTO and running the engineering team, Chris is our acting application architect and is building the back end of our system. In the past few weeks, we have brought onboard a Front End Architect, a Senior Software Engineer, and have one contract engineer working on our back-end.

I decided last fall to build a remote first team, rather than insist everyone work together in an office, and we are investing in building a successful remote culture. The strategy has served as a major catalyst to bringing onboard extremely talented people at reasonable salaries, and has allowed us to operate without disruption during the evolving Coronavirus crisis. I am more convinced than ever that our remote strategy will continue to be a major asset to our business in the coming months and years.

Product

We continue to make substantial progress on early product validation and development.

We conducted our first round of prototype reviews in late January and early February, which followed the substantial customer discovery work that I completed last fall. We spoke with about 20 potential customers, and overall we received strong validation that we are solving an acute problem for teams and that our approach is compelling. We are now in the process of turning around a new version of the private beta concept based on the feedback we received. If you would like a demo, please let me know.

From a development perspective, we have made substantial progress with regards to both R&D as well as laying down production code. We completed several technical proofs of concept in January and February, which have validated our technical approach. We have proven that we can natively integrate with our early integration partners (Google Sheets, Microsoft Excel), and dynamically imbed and interact with those products within the Workstream application.

We have been in beta development for about a month. Full team development kicked off on March 2nd. Notable milestones include finalizing our technology stack, standing up our API and web application, and building user authentication and login.

Launching Workstream

More broadly, we continue to push forward with launching the company and preparing for our private beta. Here are some highlights:

We officially launched our new website and brand identity at Workstream.io. Feel free to head over there and check things out. Keep your eyes open for an official company announcement in the next few weeks.

You will notice that we continue to refine messaging. Customers continue to validate that what we are building really goes beyond mere collaboration and that Workstream is unifying the lifecycle of analytical projects, just as the Atlassian suite and Github transformed the software development lifecycle. While thousands of engineers can seamlessly contribute to a single code base, when more than two people attempt to collaborate on a model or dashboard, the entire project becomes a complete mess. This is a really big problem that we intend to solve.

We are early in development, but we still anticipate launching into a private beta in the middle of the year. We have a dozen or so customers interested, and I’ll be working to lock in commitments following this new round of user testing.

Please don’t hesitate to reach out if you have any questions on the above, or on the business in general. Thanks again for your support -- I look forward to continuing to keep you updated on our progress.

Best,

Nick Freund

Founder and CEO

Impact of COVID shutdown (May 2020)

Hi Everyone,

I hope this finds you and your families safe. I have gotten some inbound questions from our investor group about the COVID-19 crisis’ impact on Workstream, so I wanted to kick off this month’s update with what I have seen so far and anticipate in the months ahead.

Impact of COVID

Our decision to build a remote-first team has generally allowed us to avoid major disruptions to day to day operations. However, we have of course been navigating personal impacts to our team members, be it either the stress of being shut inside, safely getting supplies, or juggling a lack of childcare. So far, the team is generally navigating the situation well and we haven’t seen material impact to our key milestones for 2020.

As I continue to engage with customers, the conversations have made it clear that our solution may be more relevant than ever in this “new normal.” (See the Product Design and Customer Engagement section below for color). That said, the current environment has certainly made it more difficult to get customers’ attention – especially considering our current customer ask is for feedback on our prototype.

To the extent the crisis extends through the summer and into the fall, which I personally believe is where we are headed, it will likely cause challenges in customer engagement in our private beta. I’m optimistic that our freemium strategy will prove itself a valuable countermeasure, as a quick-to-install and initially free-to-use product is a welcome salve in a recessionary environment.

From a financial perspective, I am relieved to report that given the success of our January financing, we have runway to the fall of 2021 given our current team and staffing plans. While we did not apply for any SBA loans, under the recovery programs we can defer our 2020 social security taxes until December 2021, which is an incremental positive for our runway.

Product Development and Customer Engagement

We are ~10 weeks into full team development, and we continue to track towards our planned private beta in mid-2020. Including Chris, we have 2 developers building our API, 2 developers building our UI, and a Product Designer working to define our product experience.

Some notable technology updates in the last month include:

We have made significant headway with our Excel/OneDrive integration

API development is ahead of schedule, currently a bit behind on the UI

Completed implementation of our event infrastructure, and designed our notification system

Beginning QA on the web application

From a design perspective, in the last month we completed another version of our clickable prototype, and conducted another round of customer testing. Customers continue to indicate that we have a compelling approach, and make initial commitments to being beta testers. They are also providing constructive feedback on various UX changes that we are incorporating into our final design for private beta. By next month, I anticipate having a fully refined prototype of our entire private beta experience.

Moreover, amidst the crisis, the tone of customer conversations has changed. There is a nearly universal consensus that the current situation – in which every team has had to transition to remote work, while simultaneously needing to re-assess, reforecast and replan their business, makes our solution more timely than ever. I’m optimistic that we can respectfully leverage this dynamic to generate positive momentum for our product launch.

Launching Workstream

As you should have seen, we formally announced the company at the beginning of April. Our goals were to start generating awareness about the product and vision, and begin to tell the Workstream story in a way that will authentically connect with customers and the ecosystem.

The reaction far exceeded my expectations, with over 10,000 views of the announcement & blog post on LinkedIn, and lots of inbound interest and traffic to the Workstream site. Some notable reactions include:

“This is pretty intriguing. I always think that in finance it's super difficult to track model versions or have multiple hands in a model at the same time. We would love to test the beta. Let's catch up and discuss when you have some time.” -- Financial Services Director w/ $25B under management

“This product could solve some real, acute pain points that my team experiences...I look forward to participating in the beta when the time comes.” -- VP Finance, 100 person tech company

“Nice to connect and congrats on your launch. I work on analytical projects all day long and collaboration on teams is always a nightmare. I can think of countless times where version control on financial models, customer files, etc and getting feedback from multiple people via email have been a nightmare. When I saw your post, it immediately resonated. I would love to beta the product.” -- Financial Analyst

“The struggle is real and this is an exciting solution. Congrats!” -- VP of Operations, Media

While our initial proof will be, of course, adoption at launch, I believe that we have more than ample validation to continue aggressively moving forward.

If you have any questions, please do not hesitate to contact me.

Best,

Nick

We are in alpha! (July 2020)

Hi Everyone,

As always, I hope that this email finds you and your families safe in this crazy time. Without further ado, here are some details on where we are at Workstream:

Alpha and Beta

I could not be more excited to report that we are officially in alpha, and that we have begun our initial customer tests!

Over the past few months, Chris has done an incredible job of keeping our team focused and productive. I find this particularly remarkable given we only began product development on March 1st, and the COVID crisis consumed the US a few weeks later. Since then, we have onboarded new team members, built the entire front and back-end of the application, gotten our Chrome and Firefox extensions listed in the respective stores, and launched our alpha product.

We have officially begun alpha tests, which started with Chris and I collaborating on the company financial forecast a few weeks ago, and now includes some of our close design customers that we have been working with during development. While it is very early, the initial feedback has been generally positive and constructive.

Product-wise, our initial “customer hook” includes the ability for customers to kick off and scope out their projects, and consolidate their modeling, feedback and iterations into a single experience. With regards to integrations, we are launching with support for Excel/OneDrive, which is the foundation off which we will build future integrations — from Google Sheets, to Looker and beyond. During this phase, our goals are to understand whether our initial release is actually minimally viable, what features and tweaks are needed to get fully there, and to work out enough of the bugs and kinks that we feel confident in proceeding further.

From alpha, we will look to fast follow with our private beta phase. Over time we will open up from a few to the few dozen design customers already lined up. Beyond initial usage and feedback, our goals will be to establish the 1-2 initial use cases Workstream solves, and solidify the roadmap of features and future integrations that will allow us to solve these use cases from end to end. More details on this soon.

From a customer adoption perspective, we anticipate better understanding how Workstream lands within a finance organization and organically expands to support stakeholders and leadership across a business.

The space and the opportunity

While customers — having felt the acute pain points around running analytical projects — have understood and been enthusiastic about our vision since the beginning, it feels like conversations have been changing in the past few months.

As I have continued early business development, and content marketing, it just feels as if there is broader consensus that the space we are in has huge potential and is in many ways a blue ocean. No vendor has yet supercharged the workflow of analysts, or how their teams manage their projects and influence decisions made across the business.

Accordingly, others have started to see the opportunity, and in the past few months I have seen a handful of startups cropping up in our space. I feel this burgeoning interest in the space is great validation that we are onto something big, but I truly believe that our product, vision and take on how to solve customer problems is unique. That said, to seize the opportunity and become the leaders in our space, we need to continue moving forward with deliberate speed towards our beta. We must continue to invest in telling our story in an authentic way in order to make ourselves as broadly relevant to customers as possible when open up into public beta.

If you want to read more about how we are beginning to position ourselves, you can check out my latest blog post (Why the Best Analysts are Developers). It speaks to what I believe is an opportunity to pioneer a new, innovative way by which teams manage analytical projects. In the upcoming months, we will spend more time investigating the past, present and future of analytical work, and how Workstream is at the forefront of a new solution category.

As always, please do not hesitate to contact me if you have any questions, or are interested in seeing the product in action.

Best,

Nick

Private beta & initial learnings (October 2020)

Hi Everyone,

I hope that you are having a good start to fall, and are finding some semblance of normalcy amidst a turbulent year. I am excited to provide an update on where we are with our private beta, and some of our key learnings to date.

“Phase 1”

We are working with a handful of customers and are learning a lot from their feedback. We are releasing product fixes, optimizations and new features every two weeks.

These customers are best in breed analyst teams, working at companies of 300+ people. By best-in-breed, I refer to both their influence in the organization and the tools they use. These teams are the decision making nerve centers of companies, and leverage everything from Excel & Google Sheets to the modern data stack. While their titles may include finance, strategy or data, what unifies them is how they work, the toolset they use, and how they support and influence the business.

When investing in Workstream this past January, a few successful founders of other companies told me that our ability to respond and make changes is what will determine our success. I have a firmer appreciation for this dynamic as we seek product-market fit, and pioneer what I believe is a completely new product category. We are not building a better mousetrap, and there is no Gartner magic quadrant for what we do.

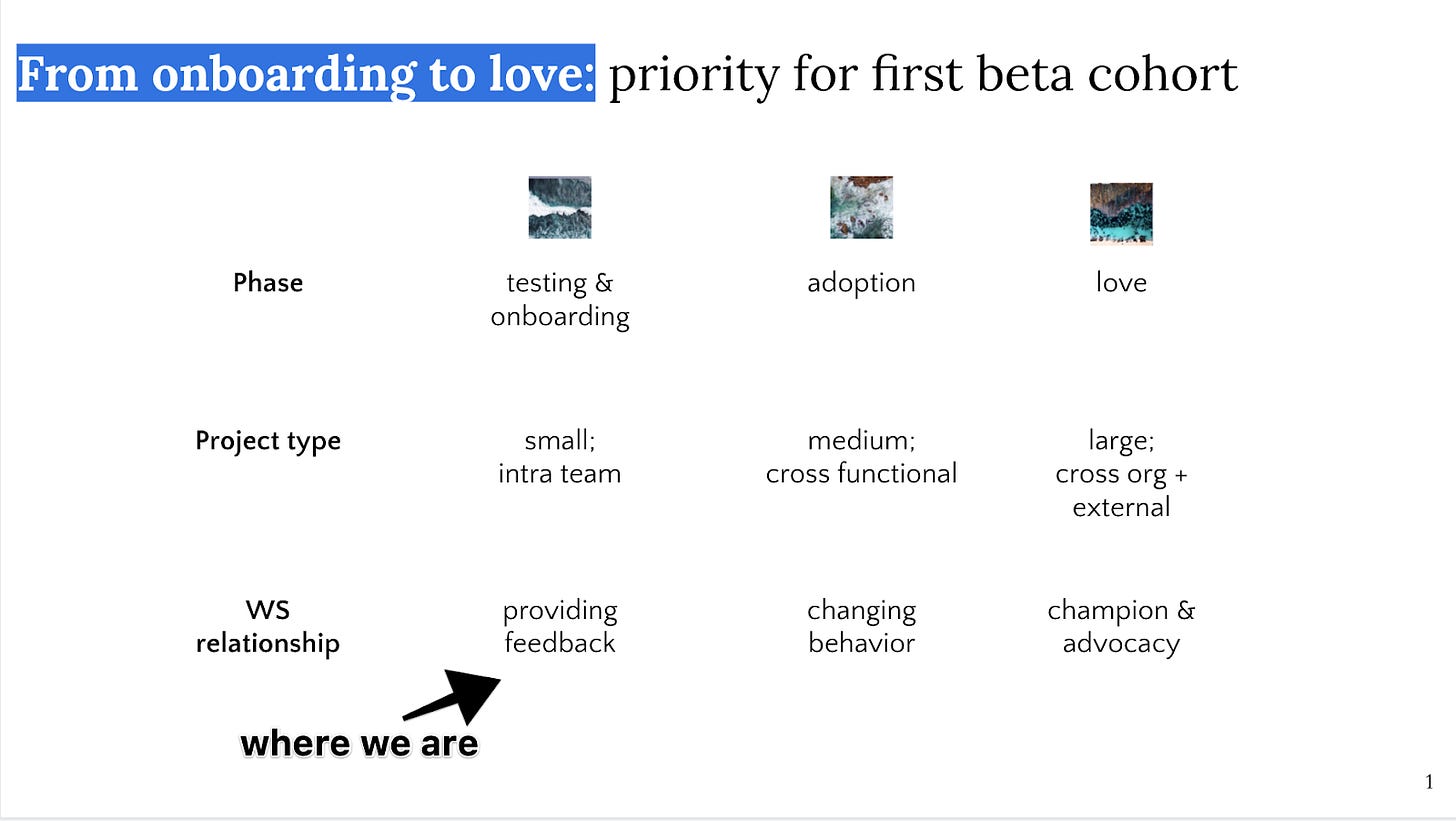

At a recent Workstream team meeting, I shared how I believe this dynamic translates into our evolving relationship with customers, how they leverage our product and get value from Workstream:

While the framework risks being overly simplistic, to break it down:

Phase 1: Customers begin testing the product and onboard their core team. They start providing us feedback on what is and is not working.

Phase 2: We have sufficiently actioned the feedback that users begin organically adopting Workstream for various projects, and experiencing day to day behavior change. Our user base expands beyond the original, core team.

Phase 3: Our customers begin to have an emotional connection to Workstream, and cannot imagine life without us. They champion the product internally and externally, and user adoption snowballs.

With our first few design customers, we are still in phase 1. Our goal is to get this cohort into phase 2 by early next year.

Highlights

As users see and get their hands on the live, working product, their reactions continue to validate that we are pursuing a big opportunity and are addressing acute pain points. Here are some of the exciting reactions:

“It feels very refined for a beta product. The design is great”

“The product is different, but it reminds me of Notion”

“This is Ironclad for Finance”

“The versioning and conversations remind me of Github”

“You are onto something really big here, right now we get feedback all over the place”

“Eventually introducing this into corporate planning would be invaluable”

“This is far more interesting than I originally thought”

“Your decisions to meet people in the communication channels they are used to [currently email] is really smart”

“Being able to scope and manage a project within the same area [as collaborating on it] is super powerful”

“Even just wrapping a conversation around Excel is huge”

“This could solve our issues in a way that even Google Sheets comments do not”

Feedback & Changes

Here are some of the things we’ve learned and the changes we are making:

Optimizing onboarding

While we were building, we spent a ton of time trying to think through and optimize how customers would install and start getting value out of Workstream.

Our goal is that customers can install, create their first project, and get to that initial WOW moment within 5 minutes. This is in contrast to most analytical tools that take months or years of implementation and user training. Having taken users through installation more than a dozen times, I can confirm that some customers have seamlessly onboarded, and get to that wow moment quickly.

However, given the nature of our product — a workflow solution that integrates with existing analytical tools, starting with Excel — our v1 came with some limitations. Specifically, users have to authenticate using their Microsoft credentials and connect us to their OneDrive account. This is how we currently store and render their files.

These limitations have resulted in customers either a) not being able to complete onboarding, or b) having to work internally to get proper Microsoft licensing so that they can start testing. These issues create unwelcome friction, and prevent us from building a true bottom’s up, flywheel business. Accordingly, we are working on a few immediate changes.

In the last few weeks we have launched support for Google authentication: now any user can easily create a Workstream account.

More excitingly, I’m happy to announce that we have been accepted into the Microsoft Cloud Storage Program. The APIs available in the program will allow customers to use Workstream without any other platform dependencies, making storage integrations (ie OneDrive, Dropbox or Google Drive) optional, value added functionality. The APIs give us more control over the end to end customer experience, and unlock some of the more advanced features on our roadmap.

While integrating with these APIs is a technical lift and comes with new infrastructure to build, this change will be key to reducing friction and transitioning from phase 2 to phase 3 next year.

Behavior change

Throughout this initial stage of the beta, one of the issues we have heard is that we are asking users to go through significant behavior change. This takes time and comes with unique challenges.

While the current workflow of complex analytical projects — emailing versions of the model back and forth, or slacking snapshots of the dashboard — is recognized as clearly broken, customers have to choose to change their behavior. And then they need to invest in and champion the Workstream way. While this poses a short-term challenge, it also presents an opportunity long term to create true customer love and stickiness.

We have certainly seen this dynamic at play in the early days, with customers installing, doing some initial testing, but not yet introducing us into their active daily workflow.

While there are lots of lessons here, one of the big customer asks is for a more flexible, lower friction way to get analytical artifacts (ie. Looker dashboards, Tableau reports, etc) into our application. This will shorten our time to WOW, and lower the bar to the behavior change we are asking of customers.

Thus, our other main focus in Q4 is a dashboard capture feature. This will allow analysts to quickly grab dashboards, and pipe them into Workstream so they can request feedback, and manage iterations.

The bottom line is that we are excited about our results so far, and the customer feedback that is helping us both improve the product and validate the opportunity ahead.

As always, please do not hesitate to contact me if you have any questions, or want to check out the product.

Best,

Nick

The first pivot

ICP Pivot to Data (Jan 2021)

Hi Everyone,

I hope that this update finds you well. I have spent time in the past few weeks looking back on 2020, and it is pretty amazing how much we have accomplished.

In a single year, we went from a high level insight that the analyst workflow was broken, and the general outlines of a product, to a real company with funding and 5+ passionate team members.

We launched into alpha late summer, and since the fall have been working closely with engaged customers to rapidly iterate and evolve our beta. We have onboarded customers who acutely feel the pain we are solving and believe in our vision. We have alignment on our roadmap, and early validation from critical technology partners.

We are moving forward with relentless focus on delighting our beta customers, and transforming them to daily users that live in, love and could not imagine replacing Workstream.

Customer Profile

We continue to sharpen the definition of our ideal customer, which we have always defined as the "modern analyst." Our ideal customers are analytics and data teams at companies of 300-5,000 employees. These customers leverage best-in-breed analytical tools to deliver insights to the business, and increasingly are transitioning from more traditional tools like spreadsheets to the modern data and analytics stack.

This modern analyst needs to be technically proficient (i.e, they have deep expertise in SQL, can dabble in Python, can build visualizations in Looker), be a great analyst, and have a high degree of business competency. While somewhat technical, this article from Andreesen is an amazing overview of this emerging analytics stack; I believe we live in a new box to the right of the "output" column here representing workflow between analyst teams and business stakeholders.

We believe that how the modern analyst leverages the output of these tools to empower the business is still broken. The quote below from one of our customers speaks directly to this pain, much of which the Workstream product can already solve today:

"Most of the financial "modeling" for this project is in Mode, and right now I'm taking screenshots of each scenario, and then pasting into a Google Slide. Comments from stakeholders are a mishmash of Slack threads and comments on Google slides. It is cumbersome to keep track of conversations, and know when a critique should result in a new analyst work "ticket". The final product lives in Google Slides, and is exported into PDF to be shared with external entities."

Product

With a more refined definition of our ideal customer profile has come a more consistent and aligned signal on where we should be headed with the product. We are moving aggressively to action this feedback, and launch new features every two weeks.

Here are some highlights from the past few months (links included to product updates with visuals and more details):

Dashboard capture. Analysts can now build dashboards in their visualization tools, associate them to Workstream, and request feedback from stakeholders.

Dashboard annotations: Users can annotate their dashboard with drawings and graphics.

Video support: users can embed a Loom video in a Workstream discussion to more quickly explain a topic.

Storage system & updated notifications. We released our new storage system to improve performance. We also added additional notification options based on customer feedback.

Looking forward, here are some of the big features that we believe will take user adoption to the next level, and motivate new companies to come onboard as Workstream customers. The key themes are both a) integrating Workstream natively with business intelligence/visualization tools, and b) providing richer experiences to empower stakeholders.

Dashboard embeds: This is the next evolution of our dashboard capture feature, allowing us to support fully dynamic dashboards alongside a history of static snapshots. We intend to support all visualization tools that allow for embedding with this release.

Browser extension: this will bring our core functionality (conversations around data and analytics) directly alongside the visualization tools our customers are using (i.e, Tableau, Looker, Mode, etc).

Workstream concierge: A portal where stakeholders can access curated information (i.e, key reports with context) as well as make request of the analytics team.

As always, don't hesitate to reach out if you have any questions.

Cheers,

Nick

The remixed vision, and why we are 10X better (April 2021)

Hi Everyone,

I hope that everyone is having a good start to their spring. I’m excited to share some of the substantial progress we have made over this past quarter and speak more about the opportunity ahead for the business.

To start, I would like to express my gratitude to our design customers — most specifically Shaun Chaudhary, the Director of Data & Analytics at BetterCloud, and his team.

Beta engagement has been great the past few months. Here is a great quote from Mike Stone, the Head of Community at BetterCloud, just 5 minutes after Shaun onboarded him. (Use case: get feedback on a set of dashboards Shaun’s team is building for Mike): “I can see how valuable this is. There was no way to do this back and forth well before.” And then of course they pointed out 5 improvements that we are now actioning.

This input, along with that from other design customers, allows us to now — more than ever before — clearly express the product vision and how Workstream will solve acute customer pain points. Most importantly, we have alignment and conviction on what we need to remix in the product to truly unlock organic adoption for our beta users and acquire new customers.

Q1 Key Highlights

Since this remixed vision is this update’s focus, I am intentionally keeping this section short. But here are some additional wins of note:

Product

We now support embedded dashboards in Workstream, including support for Tableau, Looker, Mode and Google Data Studio.

We launched our Slack integration. Users can now create Workstream projects from Slack and leverage Slack for notifications.

Team:

We hired an additional front-end engineer and brought onboard one of Chris’ former colleagues from Roadie as QA Architect.

With these new hires, we round out our early team which now includes myself, Chris, 3 engineers, our QA lead and our product designer.

The road ahead, and the vision remixed

To empower their business, analytics teams deliver stakeholders critical operating assets, such as dashboards. Workstream empowers analytics teams to support these assets as internal products and engage key stakeholders as internal customers.

Analytical assets are internal products

One of our design customers has over 1,000 dashboards in their Looker environment. These were created over years and many are no longer relevant or actively maintained.

It is nearly impossible to communicate to stakeholders which assets are still relevant. They struggle to train business users on how to use the assets (i.e., the products) they have built and encounter problems in communicating important context about them (e.g., how to interpret what they are seeing, use various filters, known issues with the underlying data). Inversely, it is painstaking or impossible to understand what stakeholders find valuable, discover what people are using, and capture their feedback.

Workstream’s Knowledge Repository empowers analytics teams to:

Quickly associate dashboards to our product where users can view them dynamically

Communicate which assets are supported by the analytics team and curate written (or video) explanations of important context

Capture and view stakeholder usage and trends

Solicit and track stakeholder feedback

Stakeholders are internal customers

Analytics teams struggle with an endless stream of inbound inquiries. These might be questions about how to use a dashboard. Or, they could be requests for feature changes on an existing asset, or a completely new dashboard or set of dashboards that need to be created.

Even the best teams struggle with maintaining this workflow, because there is no system that has been purpose built to manage it. Most inquiries start inbound via Slack or email, and the best solution for providing visibility is a shared slack channel for each department (i.e., data-marketing, data-sales, etc). Some teams leverage JIRA Service Desk, or even tools like typeform or google forms to collect stakeholder requests. But the experience is painful, requiring stakeholders to fill out annoying forms. Users then must hop between systems to navigate the request and what was delivered to fulfill it.

Workstream’s Concierge empowers customers to:

Ask questions and create requests from where they originate: the dashboard itself

Iterate on requests directly on top of a dashboard or report

View, manage and fulfill your team’s queue of inquiries faster

Pin frequently asked questions and open items to assets, clarifying the existing known issues for stakeholders

Why Workstream is different (and 10x better!)

Unlike existing solutions (for example: a corporate intranet with documentation separate from their business intelligence tool, or handling requests via Slack or a more traditional service desk and using screenshot links for feedback), Workstream brings these disparate elements into a single, integrated experience built on top of a company’s live data assets. We meet users where they are and thereby supercharge their workflow.

In this way, our product is not a separate destination. “It is embedded in the work itself,” and is uniquely positioned to supercharge the workflow of analytics. Workstream gives analysts a canvas to communicate knowledge about the products they deliver, capture unique insights about how those products are leveraged by internal customers, and increase the velocity by which teams deliver on requests and answer questions.

I am excited to keep you posted on our progress towards this remixed vision soon. As always, feel free to reach out to me with any questions.

Best,

Nick

Remixed use cases and pain points (July 2021)

Hi Everyone,

In our last update, I shared the details of our remixed product vision and how it would empower analytics teams to support the assets they create like products, and to treat their stakeholders like customers.

I am excited to announce that over the past few months, we have delivered v1 of our remixed product vision, across both our web application (aka, our Knowledge Repository) and our browser extension (aka, the Workstream Concierge).

📹 A Loom is worth a thousand words. To check out the product, feel free to view here. (Watch at 1.5X speed to save yourself some time).

Since we launched the remixed product a month ago, we have doubled our beta customers. Within existing beta sites, more power users (i.e, data analysts & analytics engineers) are onboarding onto our system, and we are seeing them actively add and curate assets within their workspaces!

⭐⭐ Key ask -- Intros to Data & Analytics teams ⭐⭐

If you have a friend or colleague that is into new analytics tooling, and wants to better manage their data products & support their stakeholders, please reply to this email!

As a reminder, our ideal customer profile is data & analytics teams leveraging the modern data stack at forward thinking companies of 100+ people. We currently support customers using Tableau, Looker, Mode and Google Data Studio -- but can easily add support for new providers within a week.

💥💥 Core use cases & corresponding pain points 💥💥

Based on engagement with beta customers, we are increasingly focused on a few interrelated use cases. These all revolve around the issues experienced in communicating context around your data, and having to manually answer questions across fragmented systems. This leads teams to waste time and make decisions based on misinterpreted or outdated information.

Use cases include:

Managing the lifecycle of analytics/data products: when your Looker instance has 1,000 dashboards, how do you understand what your internal customers are using and find valuable? How do you communicate to customers what the data team actively supports, and programmatically deprecate what isn’t in use?

Enabling customer training & communicating context: When you have delivered a product, how do you curate and communicate to your internal customers important context? How do you train new customers how to use the products that you have already built?

Getting feedback when building new products: When building something new, how do you streamline the broken workflow of receiving feedback from stakeholders and colleagues?

🚀🚀 The path forward 🚀🚀

We continue to learn firsthand what the smartest founders and investors have been telling us since the beginning. As Mixpanel and MightyApp Founder Suhail Doshi recently wrote, getting the product right takes “a lot of time, iteration, and grit.”

We are moving forward with deliberate speed, and building upon our solid product foundation to deliver the end-to-tend experience that customers indicate is extremely valuable and which they are willing to pay for. Conversations are transitioning from “this is nice to have” to “what you are building is a must have solution to acute problems we experience.” Many customers have built, as they put it, “janky hand rolled solutions” to these problems that “don’t work well.”

Accordingly, this is what we are focusing on in the upcoming months / the rest of the year.

Accelerating time to wow for our power users (data teams). Right now there is some effort required for teams to set-up and curate their workspace; we want to make this increasingly programmatic and automated. Time to wow should be 5 minutes or less.

Delivering the features that unlock our core use cases & rollout to stakeholders across the business. We will prove that after their wow moment, a single analyst will roll out our solution first to their colleagues on the data team and all of their key stakeholders across the business.

Expanding the private beta & preparing to open up the product.

We are establishing a playbook to make customer wow moments and internal rollouts repeatable and predictable for anyone who onboards onto Workstream. This is what will give us the confidence to make aggressive investments in customer acquisition (and monetization).

In preparation, I am building a pipeline of candidates for the business side of the organization. We are also working to revamp our corporate identity & website to align with our remixed vision and vector.

I hope that you are as excited as I am about the progress that we have made, and the opportunity ahead. I look forward to updating you again in a few months, and as always please don’t hesitate to reach out with any questions (or customer referrals 😄).

Best,

Nick

Managing 10K analytics assets + faster time to wow (Oct 21)

Hi Everyone,

In my last update, I wrote about launching the remixed product, and the core use cases it was unlocking. This time, I am focusing on how we have accelerated time to wow for our power users (data teams) and are enabling rollouts to their stakeholders.

⭐⭐ Key ask -- Intros to Data & Analytics teams ⭐⭐

As always, if you have a friend or colleague in data & analytics that wants to better manage their data products & support their stakeholders, please reply to this email!

Milestones of note

New website! We reworked our external brand and messaging to reflect the remixed product. People now just “get it” faster, and our inbound interest is increasingly from folks matching our ideal customer profile.

Provisional patent application filed: We filed a provisional patent application for the technology by which we register assets, dynamically embed them, and render Workstream content within the native UI of data visualization tools (i.e, Looker, Tableau, etc).

Customer usage: We are now seeing daily usage from beta sites! We still have more work to do, but this is obviously great to see.

New features: As always, we have been busy evolving our product these past few months. In addition to actioning customer feedback, notable features include enhanced navigation, global search, asset lifecycle management, and lifecycle automation. We also enabled support for Google Sheets and Looker explores as new asset types.

Managing 10,000 analytical assets & faster time to wow: Our product has always been integrated with the front-end of analytics tools. Thus we can facilitate data-stakeholder workflows on top of live data assets across our web app (aka, our Knowledge Repository) and the native UI of analytics tools (via the Workstream Concierge).

While that experience creates wow moments for customers, until recently they had to manually add assets to our system. This resulted in even our most engaged customers having only a few dozen assets in their workspace.

This quarter, we also delivered API integrations for Tableau, Looker and Mode. During onboarding, we now bulk import thousands of assets, and help teams get them organized, in a few minutes. And then each day we detect & sync anything new for curation and categorization.

Customers now get to wow moments in their first five minutes using Workstream, a complete sea change.

Key learnings

These past few months have brought some of our most significant learnings to date.

Workstream is a two sided network

Our strategy has always been to land with analysts and have them bring us to their stakeholders. We see this dynamic today, as teams use Workstream to certify assets and communicate important context to stakeholders. We have the early signs that this will soon yield mass rollouts to data stakeholders at our customers.

Excitingly, our product gets more powerful as more users within an organization adopt it (i.e, there are network effects). Specifically, stakeholder engagement is captured to provide data teams rich insights about how their products are being used, and inform automation that takes unused or stale assets to end of life.

For a customer to be successful, the incentives for data teams (i.e, suppliers) must be strong enough for them to bring our product to their stakeholders (i.e., consumers). And there must be enough immediate value for stakeholders to adopt and engage data teams using Workstream.

Expanding our integrations & automation

We are thinking more about how we can integrate more fully with data teams’ core tools, and automate their workflows.

In an update from earlier in the year, I wrote about this article from a16z and our place in the modern data stack. I believe we are pioneering a new category to the right of the output column in this diagram: cross functional analytics workflows.

While we’ve already integrated with providers in the data consumption layer, it is clear that integrations with providers deeper in the stack will supercharge value and incentives for all our personas. Our efforts here will expose to data consumers key context about (for example) data quality, and automate how data teams communicate underlying issues to their customers.

Wrapping 2021

Product

We are acting on input that we should “go deeper” by building a DBT integration. (If you want to learn more about them, read this). We are on track to have our integration complete by DBT’s second annual Coalesce conference in December, where we are a sponsor.

In parallel, we are working on an integration with JIRA to automate the process of creating, iterating on, and delivering stakeholder requests.

Existing customers have indicated these will catalyze stakeholder rollouts.

Customers and fundraising: We are focused on growing the beta group, and expanding usage and our footprint within existing sites. We are also getting ready to raise an institutional Seed round. More on our progress here soon.

Best,

Nick

Closing the Seed (Apr 2022)

Hi Everyone,

It is a bit overdue, but I am excited to provide this group of investors and supporters with our latest company update. While I am reminded nearly every day that building a company is not a straight line – see the below from friend and founder of Modern Treasury Dimitri Dadiomov — we continue to make progress with the product & business.

I’m excited to share that we closed a $4M+ Seed round, continue to see more product adoption of our private beta, and are headed towards our public beta launch!

⭐⭐ Ask: Intros to Data & Analytics teams ⭐⭐ As always, if you have a friend or colleague working in data & analytics that wants to better manage their data products & support their stakeholders, please reply to this email!

⭐⭐ Ask: Employee Referrals ⭐⭐ We will kindly take referrals for any of the below roles!

Milestones of note:

We closed a $4M Seed round led by well known VCs, with participation from numerous angels – including existing investors, as well as founders/leaders from well known technology companies. I will share more details in a formal announcement in the upcoming months.

We are seeing daily active usage with private beta customers, with compelling DAU/MAU. We are also seeing rollouts happening to data team stakeholders. Note: we will soon begin to share measurable metrics in these areas.

New features

We have been working hard to act on user feedback, improve our product experience and let customers get more out of our existing feature set. Enhancements include asset tagging, asset filtering, asset sorting, a new asset grid view and conversation enhancements.

We now support in-application training guides: this will be key as we open up the product for anyone to install.

Our product now exposes upstream data quality issues via our asset status pages

New integrations / supported asset types

dbt Cloud: we now have an integration with dbt Labs’ flagship product. This powers our status pages and opens up compelling future functionality.

JIRA Cloud: while everyone hates JIRA, it is still the standard for agile project management. This integration auto-magically creates JIRA tickets whenever teams make requests in Workstream.

Support for Thoughtspot Liveboards and Answers

Support for Salesforce assets: This dramatically opens up the types of data assets that we can support, including those found in operational systems used across businesses.

Key learnings: Here is a selection of some of the key things we have learned from the past months.

User adoption patterns: as mentioned last time, our product is a two sided network, with data teams (our evangelists) on one side and stakeholders (product managers, customer success managers, leaders, etc) on the other. So far we have largely landed with the former, but we have seen a couple exceptions. If we can prove out how to successfully land across both personas, it could be a huge unlock with regards to our go-to-market. There is work to be done here as we get into public beta.

Product messaging: the messaging framework of our product helping “data teams support their assets like products, and their stakeholders like customers” has largely resonated with customers in the past few months. It has also helped clarify product messaging around key feature sets, such as:

Kill your service desk and collaborate with stakeholders directly in context with your live data assets

Train your internal customers with embedded documentation, training videos and FAQs

Expose status pages to instill trust in your products

Understand data environment trends, including how your data products are being used, and add value to the organization

Single player use cases: we continue to get consistent feedback that the “understanding environment trends” aspect of our product is the most relevant to daily, single player workflows for data teams. This is especially true for teams that have invested in enabling self-service analytics. We are going to double down on this in the coming weeks by:

Improving the experience of that feature set & exposing additional insights to data teams.

Offering a “stakeholder version” of this same feature.

Competitive landscape: Even among early stage companies, I still have not seen a truly competitive solution to us.

Most tangentially relevant are data discovery or cataloging tools.These aren’t directly competitive, especially as I consider our vision and roadmap.

This means that we are still largely pioneering our own category, which of course is both a good and a bad thing (especially in a space with so many categories of tools).

Next steps: here are some of the things we are focused on in the upcoming weeks and months.

Launching into public beta this summer

Getting the word out: we will start to more publicly evangelizing our approach and the new category that we believe we are building

Investing in touchless customer enablement & continuing to shrink time to wow/value for newly onboarding customers

As always, we appreciate your support for the company. Again don’t hesitate to reach out if you have any questions about progress to date or where we are headed next.

Best,

Nick

Monetizing Data Knowledge Management

Public Beta Launch + Building the Biz Team (August 2022)

Hey Everyone,

I am excited to provide you with an update on our progress since we opened up our public beta earlier this summer and announced our Seed financing. As always, I will discuss the road ahead and what we will focus on in the next few months.

⭐ ⭐ Key ask: If you know anyone looking to consolidate disparate data assets into our analytics hub and better manage business workflows, please reply to this email. We are seeing traction with Data & Analytics and RevOps teams as landing personas within organizations.

We are actively building a pipeline of formal pilots; anyone can create a free trial at workstream.io.

Hiring:

In the months since closing the Seed financing, we have spent time augmenting our fantastic technology team with business talent.

This brings our team to a total of 11 and speaks to our focus on building new muscles around go-to-market – specifically generating broader awareness & growing our customer base – and more rapidly deploying customers. Hires include:

Adam Guan, Software Test Engineer

Ethan Peterson-New, Customer Enablement Manager

Robin Francis, Director of Marketing

Joe Gannon, Account Executive

Given the current macroeconomic environment, we feel this strikes the right balance between bringing on the right resources to accelerate building the business and managing cash burn.

Successful Deployments:

Before the announcement, we had seen enough successful deployments in our private beta group to understand what a successful deployment looks like and how to enable it.

An analytics person creates a workspace, builds an initial collection of assets for a specific function (we now have a long list of integrations), and curates some relevant context and documentation. They then invite other team members to join, who leverage our solution as a centralized place to access analytics & reporting and to collaborate on their data.

Usage-wise, we see huge spikes in product engagement as analytics teams (our power users) build out collections and knowledge in our system; post-rollout, adoption settles into a steadier cadence across a much broader swath of users in their org. This cycle repeats as new collections are built and new functions are onboarded. At steady state, 40-50% of users in an engaged org are active in the product every day.

We are actively working with our beta customers to convert into formal paid accounts with significant contract value. More details on this are coming soon.

Growth: Bottoms up <> Tops Down

In the weeks following our public beta announcement, hundreds of people we had never spoken with discovered our product and set up free trials via our website. Our messaging of consolidating disparate analytics assets and workflows is resonating.

As a workflow solution that is organically adopted within organizations, we will continue to invest in driving broader awareness so that prospects can frictionlessly trial our product and provide touch-less training & enablement.

Growing this bottoms-up motion is the primary focus of our marketing activities and investments, as we want more and more teams to find us and see quick value in our solution without direct intervention from us. This part of our motion is new, but as a workflow tool, we view it as critically important to our long-term growth strategy.

In parallel, we are investing in more traditional selling: direct outreach to teams fitting squarely within our ICP, as well as pilots where we work hand in hand with prospects to roll out our solution and become formal (paid) customers. This closely resembles our engagement model during our private beta, and we continue to see success with it.

As we build our go-to-market engine, we will work first to generate momentum across both vectors. And as we head into 2023, we believe our success will be about elegantly bringing these two elements together.

Current Focus:

As we round the corner of 2022, here are some of the big things we are focused on.

Doubling down on our analytics hub

As our message and the value of consolidating assets and workflows into our analytics hub continues to resonate with customers, we are investing in supporting more and more “asset types.” Today the list includes BI tools like Looker and Tableau, general productivity solutions like Sheets, Slides, & Docs, and native reporting in operational systems like Salesforce.

We are constantly working to support more analytics tools, and excitingly we have gotten into a cadence where we can release new ones quickly (i.e. within a couple of days of development). Our immediate roadmap includes product analytics solutions, data notebooks, and the Microsoft Suite. We hope to double the number of supported asset types by the end of the year.

This affords more flexibility to our analytics hub, allowing us to support more customers, deepening our ability to centralize existing customer environments, and affording us numerous opportunities for partnerships and go-to-market efforts.

As we work to make our analytics hub more extensible, we also continue to invest in making it a better, more intuitive, and refined experience. Before we begin investing again in new features and functionality, we are actively actioning customer feedback to make the product we have work better and feel more feature complete.

Go-to-market

With more conviction than ever before that our messaging and product value is resonating, and true understanding of our pathway to customer adoption and love, we are making disciplined investments in driving broader awareness of our company and our unique offering. These include:

Contributed Content to both media outlets that speak both directly to our champions, and business leadership more broadly. Feel free to read my recent article Data Teams: Kill Your Service Desk, which was published in Towards Data Science.

Speaking engagements online (videos, podcasts, etc.) with various thought leaders and at 2-3 conferences happening in the upcoming months.

Re-investing in our proprietary content, including our video series where I’ll interview business and data leaders about the interpersonal dynamics of data-driven decision-making, including their trials and triumphs.

All of this will feed our SEO / SEM strategy, with the ultimate goals of bringing people into our ecosystem and inspiring them to discover, install and adopt our solution.

I will be in touch with more of our progress in these areas. In the meantime, please do not hesitate to reach out if you have any questions or want to learn more.

Best,

Nick

Across the Pennies Barrier (Jan 2023)

Hi Everyone –

My sincere apologies for the lack of an update at the back end of last year. At the risk of oversharing, it was a difficult time for me. Our third child Isabella was born six weeks early, and then a week later my brother passed away while the baby was still in the NICU. And so my focus was really on family and keeping our business pushing forward. That said, I was remiss in keeping our group of investors updated and so my goal is to begin to remedy that this week.

Please note that since we are about two weeks away from the end of our fiscal year, I will send an end of fiscal recap (with some of the same content) to this group & our broader group of supporters in the first week of February.

FY 2022 Recap

I am happy to let you know that we are no longer a pre-revenue company! We have signed up our first few paying clients for not insignificant ($12K/year+) annual, prepaid subscriptions to our Data Knowledge Management solution.

As we look towards the end of our fiscal year (ending 1/31/23), we are pushing hard to convert a handful of additional accounts and cross the $100K ARR threshold. Within this initial customer group, there are larger accounts ($30K+ in ARR) we are working to convert, and significant, contracted growth potential. If we can capture the full opportunity in FY 2023, this initial customer cohort could more than double to $200K+.

The headwind with regards to monetization is that, as we look at our FY 2023 goals, we need more sales opportunities and pipeline, and we need to speed up our sales cycle and move deals faster. So we have work to do in establishing our category, staffing demand generation

& sales development, and creating urgency in a difficult environment to sell enterprise software.

With that, here is a broader round-up of our progress in this fiscal year, a view into where the business currently stands, and insight into our goals for FY 2023.

Financial Update

We currently have ~$2.9M in the bank, and per our operating plan we have a runway into the end of Q2 2024. In addition we have a $1M loan facility from SVB that we can draw as needed, although of course I would prefer to not put debt on the balance sheet if we can avoid it.

While the environment for fundraising has radically changed in the past year, I do feel that our runway + increasing traction will put us in a good place to raise as we head into the end of 2023 / beginning of 2024. Ultimately, the composition of our next round will be determined by our continued progress towards our goals in FY 2023 (covered at the end of this update).

User Adoption

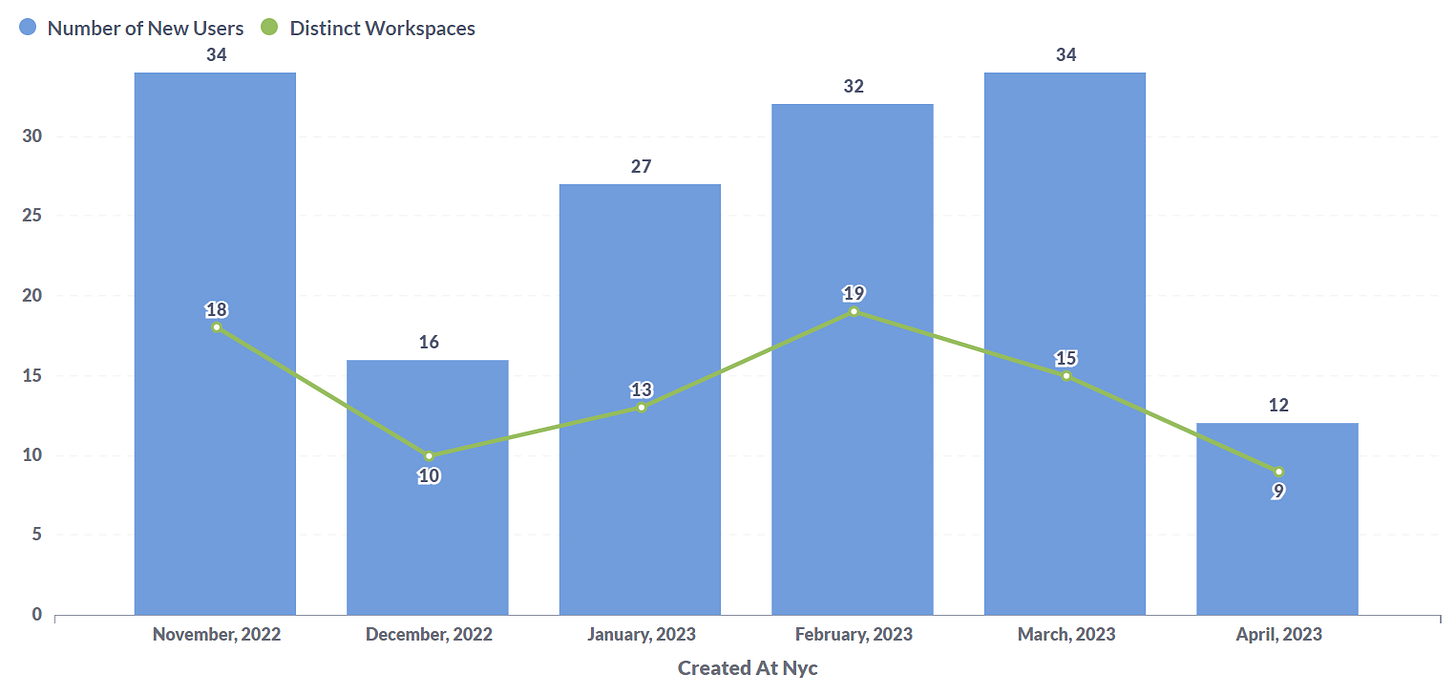

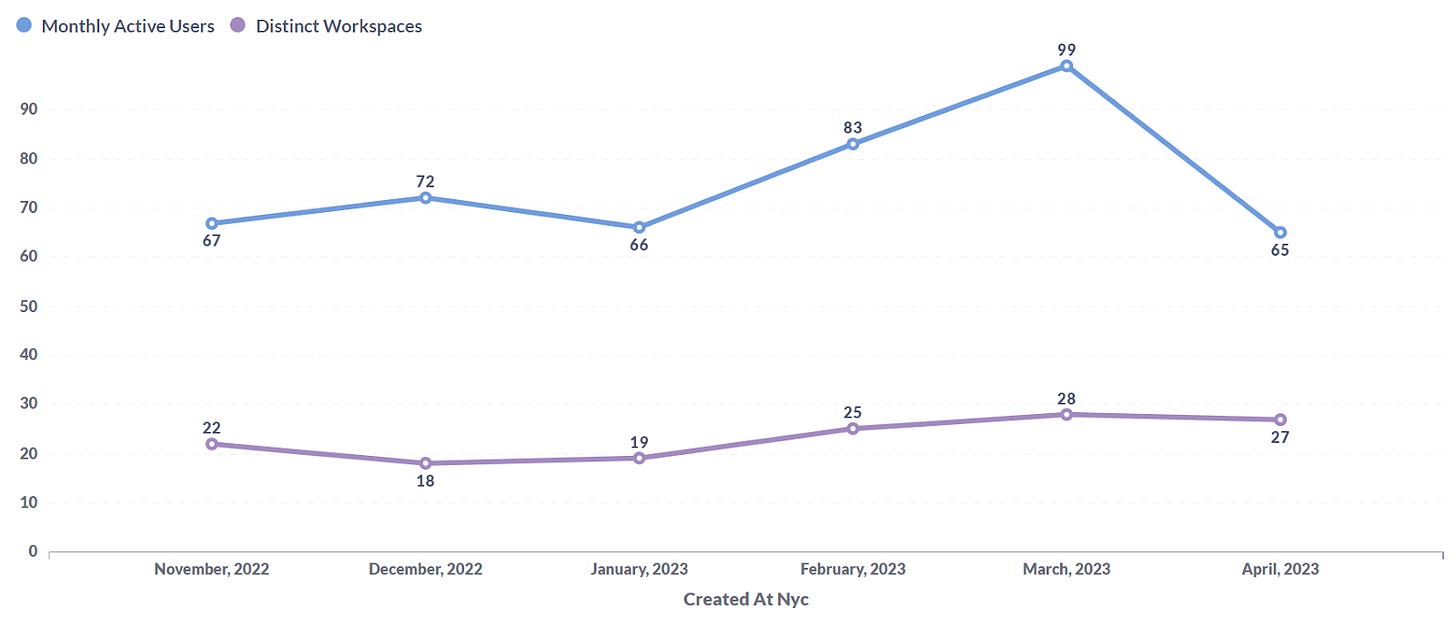

Since our public beta launch, we continue to see interest and installations of our free product. While this is a great early sign, the issue is that our larger and successful deployments require support and effort from our implementation / pilot team. We often see folks coming in to sign up, but we have not had success yet in converting them en masse to active users.

Here are some high level stats on user adoption:

16,000 analytics asset under management

400+ workspaces, with over 500+ total users

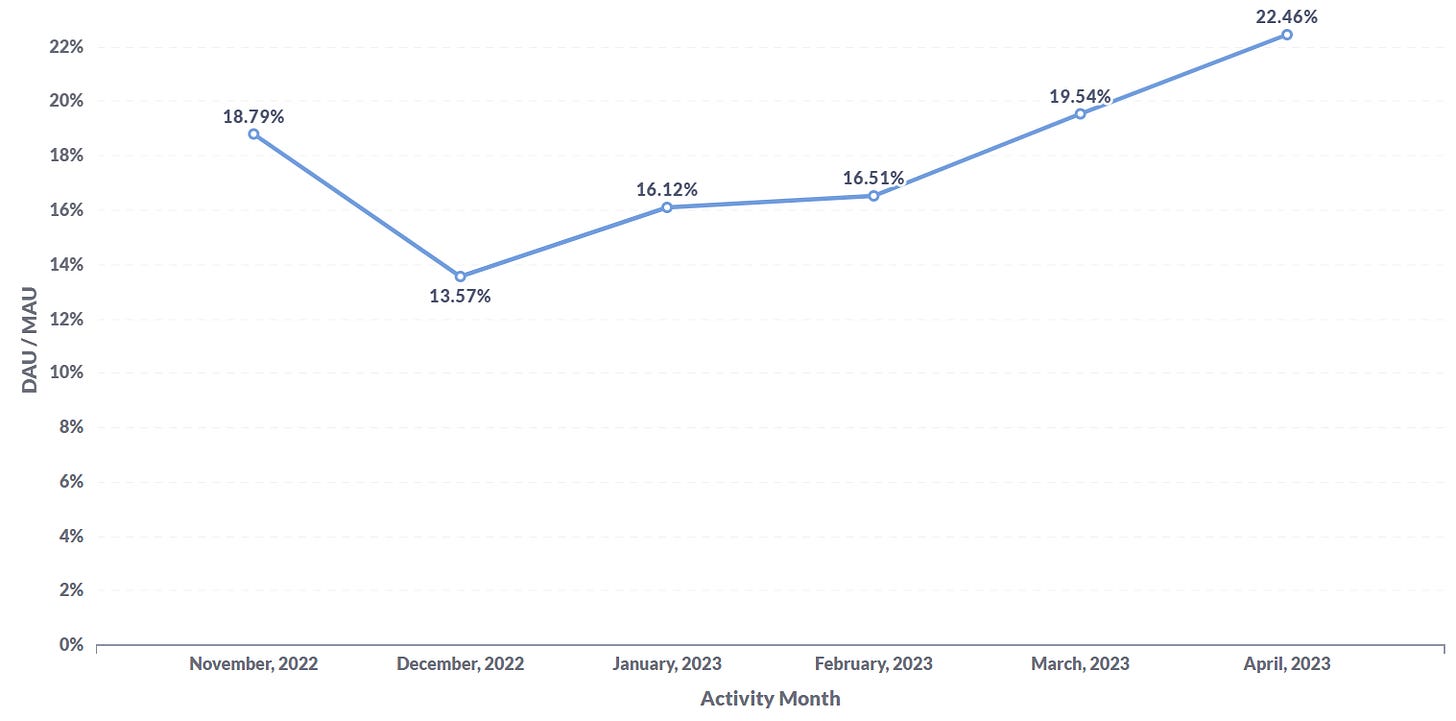

80-100+ monthly active users (+/- month to month), with DAU/MAU in the 20% range

Proving the Value of Data Knowledge Management

To illustrate the value of our offering, and why customers find it compelling, I would like to focus on a customer (Gusto) who is finalizing their purchase of Workstream; the final deal should land at $30K+ / year to start.

If you are not aware, Gusto is a US based payroll and benefits provider historically valued at $10B+. They have a massive customer support organization, consisting of hundreds of front-line employees and 60+ managers.

Ensuring that all these support managers have access to the appropriate reporting has been historically difficult, because their reporting is scattered across many different systems. In parallel, as a high growth organization, they are constantly onboarding new support managers – so training new leaders to understand and manage team and individual performance is a cumbersome, laborious effort.

We landed with an initial pilot group of less than 3 users, and are approaching an initial rollout of 60+ total employees.

Centralizing Analytics & Reporting through Data Asset Management

With Workstream, this customer is now providing centralized access to core analytics and reporting assets through our single access plane.

This includes reports from: Tableau, Salesforce, Redash, CX One, Airtable, and Google Workspace.

Initially deployed as a place to find curated and certified reporting assets, members of their workspace can also add their own reports – making Workstream the single place users go to access any data & reporting

Curating Knowledge & Managing Workflow in our Repository

In addition to consolidating previously disparate assets, this customer is also curating in-line how to guides, documentation and training videos. Each manager can not only find the reporting that is relevant to them, but they can use Workstream to understand how to use it in managing their team. And if there are questions, users can start conversations directly in context with their live data assets – all without having to visit another system.

The operational benefits are clear enough that this customer is not only buying, but making operational changes to hiring plans that allow them to directly capture a return on their investment in year 1 and justify the purchase.

Product Development

We continue to take a customer driven approach to evolving the major capabilities of our Data Knowledge Management solution, which allows teams to consolidate their disparate data assets, and empower their organizations through knowledge sharing and in context collaboration. We grew our supported integrations by 4x, and now have 25 integrations and growing across the three core pillars of our platform.

Within our Data Asset Management pillar, we made major inroads in making Workstream the place that teams create, access and manage analytics assets. A major focus was making our solution more relevant and central to every team’s environment. We now support a lot of “analytics assets,” which tactically means different file types. This includes dashboards, reports & data sets across business intelligence, data notebooks, product analytics, general productivity and operational SaaS applications. We also evolved our system’s capabilities around access control, giving users more control and transparency into how objects are shared in our system.

We enhanced our Knowledge Repository, better empowering teams to understand how to use their data assets, and best inform decision making. We enhanced our offering to support real-time multiplayer editing, and to allow teams to embed Youtube and Loom videos as part of asset documentation in our system. Finally, our dbt Labs integration now exposes upstream data quality to data consumers.

We advanced the capabilities of our Integrated Workflows to deepen our collaboration capabilities, including support for visual annotations within conversations. And we now help teams automate monotonous tasks, by automatically creating bugs in a data teams’ backlog via our JIRA connector.

All in all, we wrap FY 2022 feeling that the product is v1 feature complete, and that it is ready to support our growth plans for the upcoming fiscal year.

Looking ahead to FY 2023

As I say every January, this is a make or break year for the company. The product is ready, and so we are putting all the firepower we can into taking it to market, generating awareness of our new category, acquiring customers and activating them.

Sales and customer acquisition goals

Here are some of our high level goals moving forward:

Achieve $1M in ARR as quickly as possible.

5X the number of workspaces, users and assets supported by end of FY 2023

5X our daily active users, grow to 25%+ DAU/MAU, and increase quality of usage (time spent in the app per day) for paying customers by the end of FY 2023

Creating and evangelizing our category

While I won’t dive into our explicit plans with regards to product, sales development or customer implementation, I want to speak about our category creation efforts, as it becomes clear that we are truly building something new.

As we continue to see progress with customer adoption, and hear what is resonating with prospects, we can now name what we do (Data Knowledge Management), define its contours, and evangelize why it is so important to teams.

Our goals are to establish Data Knowledge Management as an essential solution for data driven organizations, clarify why it is different from anything else out there, and ensure we are the leaders in this new space. Two key pieces to this puzzle include launching:

the Data Knowledge Newsletter, a weekly series exploring how teams capture, curate and disseminate knowledge about their data

Data Knowledge Pioneers, a monthly video series where I’ll be speaking with data leaders and practitioners about the acute problems they face in this area

The first installment of the newsletter launched last week, and the show will be launching later this month.

New team members

Our technology team is rock solid, and so as we enter 2023 we are investing in expanding our go-to-market capabilities (both in house, and on a contract basis).

Here are some of our new team members, as well as a few critical roles on the radar.

Mary MacCarthy, Social Media Manager (contract): focused on amplifying our message around data knowledge and generating awareness of our product/category

Westin Bennett, Account Executive: Westin is our second sales hire, and he’ll be focused on helping us build pipeline and move SMB deals. He used to work closely with Joe Gannon at ProductBoard.

Ted Conbeer, Data Consultant (contract): Ted is helping us track, measure and analyze all stages of our customer acquisition and adoption funnel

Account Development Representative (TBH) : we are hiring for a high potential ADR to take our pipeline generation activities to the next level.

Demand Generation Manager (TBH): this person will own demand generation and customer acquisition campaigns to convert awareness into leads / freemium installs.

With that, I will keep you posted on our progress towards these goals in the coming months, and as always don’t hesitate to reach out if you have any questions.

Best,

Nick

Wrapping FY 2022 with $50K in ARR (Feb 2023)

Hi Everyone,

As I promised last time, here is an update on our metrics now that FY 2022 (ending 1/31/23) has officially closed. If you would like to read the latest qualitative update (with largely similar content as a few weeks back) sent out to the larger supporter group, just scroll down.

Note: going forward we will be moving our investor reporting cadence to the end of each fiscal quarter.

Sales

FY 2022 ARR: $50K (up from $0 starting in Q4 2022)

Paying customers: 3 (Collegis Education, Dr Squatch, BetterCloud)

Average revenue / account: $17K

New sales pipeline:

ARR: $203K

Accounts: 12

Product adoption

Customer acquisition

Total users: 495 (+25 in January, up 80% vs +15 in Dec)

Total workspaces (unique accounts): 309 (+13 in Jan)

User Adoption in January

Daily active users: 31

Monthly active users: 93

DAU/MAU: 33.6%

Assets

Total under mgmt: 15,761

Financials

Ending cash in bank: $2.8M

Monthly burn: $175K

End of runway: May 2024 (assumes current burn + no incremental revenue)

Notes: